GST

GST

GST

GST is a huge reform for indirect taxation in India, the likes of which the country has not seen post-Independence. GST will

simplify indirect taxation, reduce complexities, and remove the cascading effect. It will have a huge impact on businesses both

big and small, and change the way the economy functions.

GST is a comprehensive indirect tax levy subsuming all central and state levies with a single unified value added tax

transforming the nation into one single market. Major Central and State taxes are subsumed into GST which will reduce the

multiplicity of taxes, and thus bring down the compliance cost. With GST, the burden of CST will be phased out.

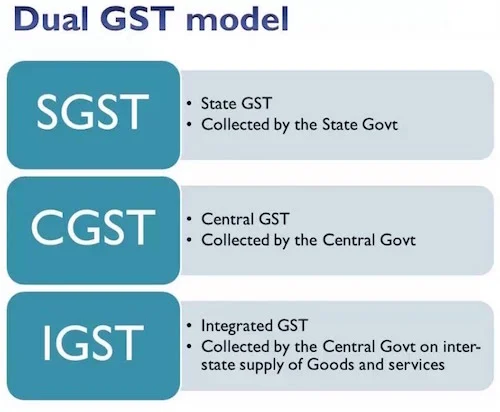

DUAL GST

– India has adopted “Concurrent dual GST” model.

Under the Concurrent Dual GST Model taxes shall be levied as per place of supply of goods and services. In case of supplies

within the State or Union Territory –

(a) Central GST (CGST) will be payable to the Central Government

(b) State GST (SGST) or Union Territory GST(UTGST) will be payable to the State Government or Administrator of Union

Territory (as applicable)

CGST and SGST will also apply in Union Territories having legislature, i.e. Delhi and Puducherry.

Advantages of GST:

- Removing cascading tax effect

- Composition scheme for small business

- Lesser compliances

- Increased efficiency in logistics

- Higher threshold for registration

- Online simpler procedure under GST

- Defined treatment for e-commerce

- Regulating the unorganized sector

DISADVANTAGES OF GST:

- GST is not good news for all sectors, though. In the current system, many products are exempted from taxation. The GST

proposes to have minimal exemption list. Currently, higher taxes are levied on fewer items, but with GST, lower taxes will be

levied on almost all items. - GST is not applicable on liquor for human consumption. So alcohol rates will not get any advantage of GST.

- Stamp duty will not fall under the GST regime and will continue to be imposed by states.

Following documents are required for GST Registration:

1.Documents Required for the private company (pvt ltd)/ public company (Limited company) (OPC)

Company documents

- PAN card of the company

- Registration Certificate of the company

- Memorandum of Association (MOA) /Articles of Association (AOA)

- Copy of Board resolution authorising director.

Registered Office documents

- Copy of electricity bill/landline bill, water Bill, property tax paid receipts.

- No objection certificate of the owner

Rent agreement (in case premises are rented).

Director related documents

- PAN and Address proof of directors

2.Documents Required for Limited Liability Partnerships(LLP) :

LLP documents

- PAN card of the LLP

- Registration Certificate of the LLP

- LLP Partnership agreement

- Declaration to comply with the provisions resolution authorising director.

Registered Office documents

- Copy of electricity bill/landline bill, water Bill

- No objection certificate of the owner

- Rent agreement (in case premises are rented) owner

- Rent agreement (in case premises are rented).

Director related documents

- PAN and Address proof of designated partners

3.Documents Required for Partnerships Firms:

Partnership documents

- PAN card of the Partnership

- Partnership Deed

- Declaration to comply with the provisions resolution authorising director.

Designated Partner related documents

- PAN and Address proof of designated partners

Registered Office documents

- Copy of electricity bill/landline bill, water Bill

- No objection certificate of the owner

- Rent agreement (in case premises are rented)

4.Documents Required for Individual/ Sole Proprietorship:

Individual documents

- Copy of electricity bill/landline bill, water Bill

- Copy of Pan Card & Address proof (I.e. Aadhar card/Voter ID)

- Photo, Email ID & Mobile No. resolution authorising director.

Registered Office documents

- Copy of electricity bill/landline bill, water Bill

- No objection certificate of the owner

- Rent agreement (in case premises are rented)

GST ADVISORY AND COMPLIANCE:

JP&CO., provides expert services on GST matters. Though the introduction of GST

subsumed as many as tax laws into one, there has been amendments and changes on a regular

basis to address the many of the hardship which have arisen on introduction of GST and also

to address the political compulsion of the government. All these changes on a very frequent

basis, have undone the simplicity of GST and consequently increasing the requirement of

Expert advice in complying with the frequently changing GST requirements. Various services

provided by us as follows:

- Obtaining Registration.

- Preparation and filing of Returns.

- Handling GST Matters & Notices

- Opinion & Advice on GST Matters

- Compliance with changes in law.

- Filing for GST refund, LUT Bond Etc.

- Representation before Tax Authorities.

- Appeal at Tribunals and Courts